|

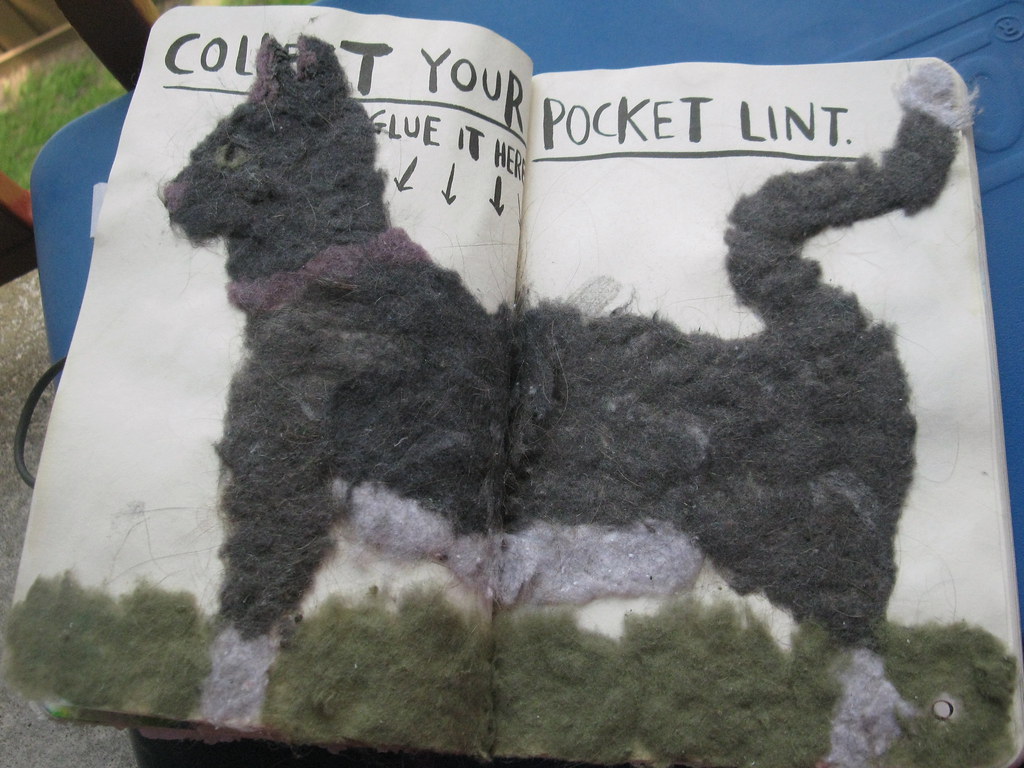

| Proooooobably needs an apostrophe |

I'm feeling a bit guilty as I write this for a multitude of reasons. The first is that I haven't posted about frugal stuff for almost a year. I haven't stopped my practices at all, it just felt like there wasn't a whole lot to say. Also is reading about all of the strangers and friends who are in a rough situation right now, and the fact that they just didn't have the same opportunities to save. I always thought of lifestyle and habit blogs like this as a 'take what you can' kinda situation. Sometimes I read advice from people I have nothing in common with, and part of my brain shuts off and I just can't learn from it. I hope that we can all, during this massive time of adjustment, emerge from the 2020 Covid Quarantine period smarter.

First and foremost: You cook. You cook your ass off, Trinity.

|

| Crockpot chili, cheap and requires no skill. |

Backlogs:

|

| Err...add 4 generations to this stack of N64 games |

I'm also clearing out all the movies I want to watch on Disney+ so I can drop the subscription and switch back to Netflix. I miss the documentaries!

Tasks around the house: Some of these are quick enough to knock out during your breaks if you're working at home.

Being home more often means I have to look at all the extra junk I live with. I have leftover flooring, sound panels, and shelving from used lots I bought from Craigslist. Getting that centralized into a donate bag, box or closet means that once donations are accepted again, I can get it out of the house and dedicate the space to something else.

My wife cleaned the refrigerator racks. Not a glamorous task, but it's gotta be done.

I sanitized all the utensils in a bleach bath. Ditto to the window frames.

Caulking and touch up paint. There's a skill gap between when I first moved in 18 months ago and what I know now about some home projects. I'll be looking to redo some of the spackling where I didn't know to sand it down before painting. Leah from SeeJaneDrill on Youtube is a sage when it comes to that.

Clean those drive-thru receipts and food bags out of your car and don't forget to wipe down the inside of your windshield.

Check expiration dates and chuck stuff. Medicine, dry and canned foods. Keep note what you're throwing out this way. Maybe you didn't need that 5-pack of Dayquil if 2 are now purple and one is crusted over.

I gave all of my shoes a bath and air dried them. The better-made pair will get another 3 months out of this while the cheaper ones will get an extra month. Also, we're almost ready to hang-dry laundry outside!

Why is this stuff frugal? A cleaner and roomier house means you stay healthier and aren't paying for things you don't use. Some people rent EXTRA storage to hold things they don't need to use daily. If you're living without it, why do you still need it?

Next is my own plug for khanacademy.org, where you can take courses for free. The courses are built under teacher supervision, and it's a great way to review what you already know or learn some new stuff! I wanted to see what universities were teaching as far as budgeting and personal finance. Personally, I think the biggest challenge to online learning like this is accountability.

Next is my own plug for khanacademy.org, where you can take courses for free. The courses are built under teacher supervision, and it's a great way to review what you already know or learn some new stuff! I wanted to see what universities were teaching as far as budgeting and personal finance. Personally, I think the biggest challenge to online learning like this is accountability.Bonus financial crossroads food-for-thought: I bought a used car for cash a while back, and it doesn't do distances very well. My income guided me to a manageable mortgage...that happens to be an hour+ drive away from friends and family, so the rare visits have an additional layer of wondering whether my car is going to make it. The current debate is whether to save enough to buy a newer car, or buy stock that's currently at a discount as everyone shifts their investment priorities. One way to still get in my visits is to rent a car each time. It sounds silly until you realize that I only make that trip a few times a year, and the rentals should equate to $400 or less, versus saving $3-4000 on top of whatever I could get for selling the car. Granted, the 2020 Quarantine is doing the decision-making currently.

Alright folks, thanks for reading and don't spend all your stimulus checks in one place!